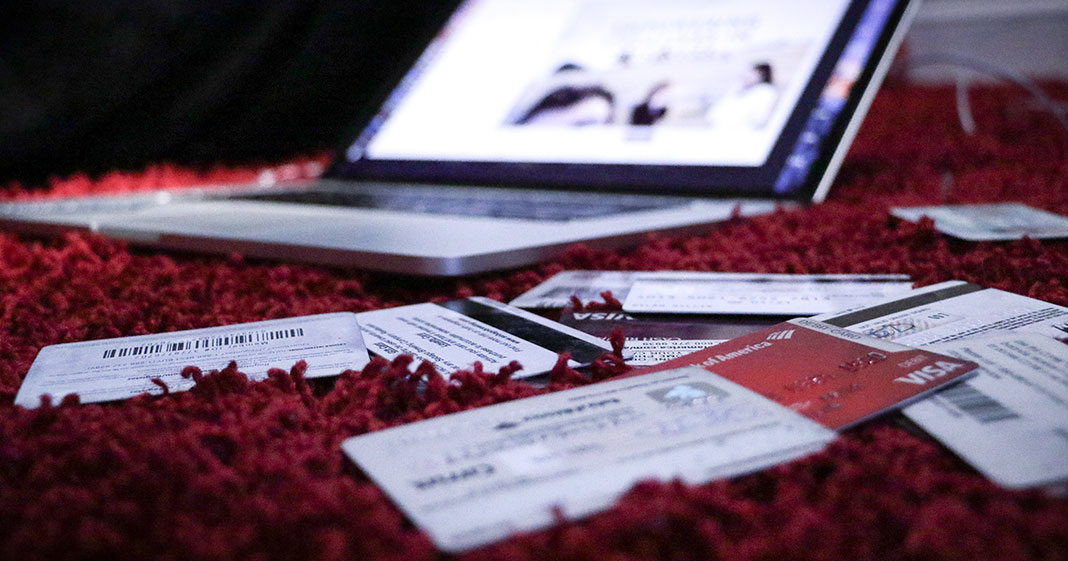

How Is Your Credit Score Determined?

Credit card firms, auto dealerships, mortgage bankers, and other lenders use credit scores to assess the risk of lending money to a borrower, as well as the amount and interest rate they would charge.

Most lenders assess creditworthiness using FICO ratings, which range from 300 to 850. Most lenders will consider you to be more creditworthy if your score is higher.

Borrowers have three FICO scores, one for each of the three credit reporting agencies: Experian, TransUnion, and Equifax. Each score is calculated using data from the credit bureau.

Why are credit ratings important?

Your credit scores may be more crucial than you realize if you need a loan to buy a car or a house. Just a few points can change your qualifying for the loan as well as the interest rate you’ll be offered. This is significant since a higher interest rate on your loan can result in you paying more each month as well as more over the life of the loan.

What constitutes a good credit score? The historical cutoff for getting the best rates without any negative rate modifications from the lender is 720.

If you avoid credit, you will not have a credit history, which can be detrimental. Your score will be poor, which can have a variety of consequences. Credit checks are conducted by landlords, employers, and utility companies. Your credit score can even influence which cell phone plan you are provided and your auto insurance quote.

What factors influence your credit score?

Your FICO score is comprised of five criteria, some of which carry more weight than others.

1. Your payment history accounts for 35% of your overall score.

Your bill-paying history is the most crucial component of your credit score, accounting for 35% of the overall score – thus it’s critical that you pay your payments on time. Setting up automatic payments that come directly out of your bank account is an easy approach to ensure you never miss a due date. Charge-offs, debt settlements, bankruptcies, foreclosures, litigation, wage garnishments or attachments, liens, or public judgments filed against you are red flags to lenders and may damage your ability to acquire future credit or credit on the best terms.

2. Your credit utilization accounts for 30% of your overall score.

Credit usage, or the amount of available credit you use, is crucial to maintaining good credit. Credit utilization should be kept around 30% as a general guideline. Credit usage is the ratio of your credit card balance to the credit limit on the card. To maintain credit utilization under 30% on a $1,000-limit card, keep your balance around $300. This percentage applies to all of your credit cards and lines of credit.

3. Credit history: 15% of your overall score

A long credit history shows lenders that you’ve been disciplined in making on-time payments, but even a short history — free of late payments or other bad elements — is beneficial. To keep older cards active, charge a recurring fee, such as an energy bill, to ones you don’t use frequently. When you reduce or cancel previous lines of credit, it can have a negative influence on your credit score, which can be disastrous if you want to make a large purchase, such as a house.

4. New credit: 10% of your existing score

When you apply for a new credit card or loan, lenders do a hard inquiry or “hard pull” on your credit, which temporarily decreases your credit score because it indicates to lenders that you are thinking about taking on more debt. If you plan to apply for a vehicle or home loan, you’ll want your credit score to be as high as possible in order to get the greatest interest rate, so avoid applying for new credit in the months leading up to your big purchase.

5. Credit types: 10% of your total score

The third component determining your credit score is your credit mix, which includes credit cards, shop accounts, installment loans, and mortgages. The overall number of accounts you have is also taken into account. Because this is a minor component of your score, don’t be concerned if you don’t have accounts in all of these categories, and don’t establish additional accounts solely to broaden your credit mix.

Increasing your score

If you want to make a large purchase, you should find out your credit score at least six months in advance so you have time to correct any errors and, if necessary, take actions to enhance your score.

It’s quite simple to determine your score. Some banks and credit card issuers already provide your credit score on monthly statements or make it available online. You can also get your credit score from one of the credit bureaus or FICO. If your credit score appears to be low, you may obtain a free annual copy of your credit report from each bureau by visiting AnnualCreditReport.com or calling 877-322-8228. If you find an inaccuracy, you can submit a correction request to the appropriate bureau(s). Make copies of every documentation you’ve kept in correspondence with the creditor.

Leave a Reply